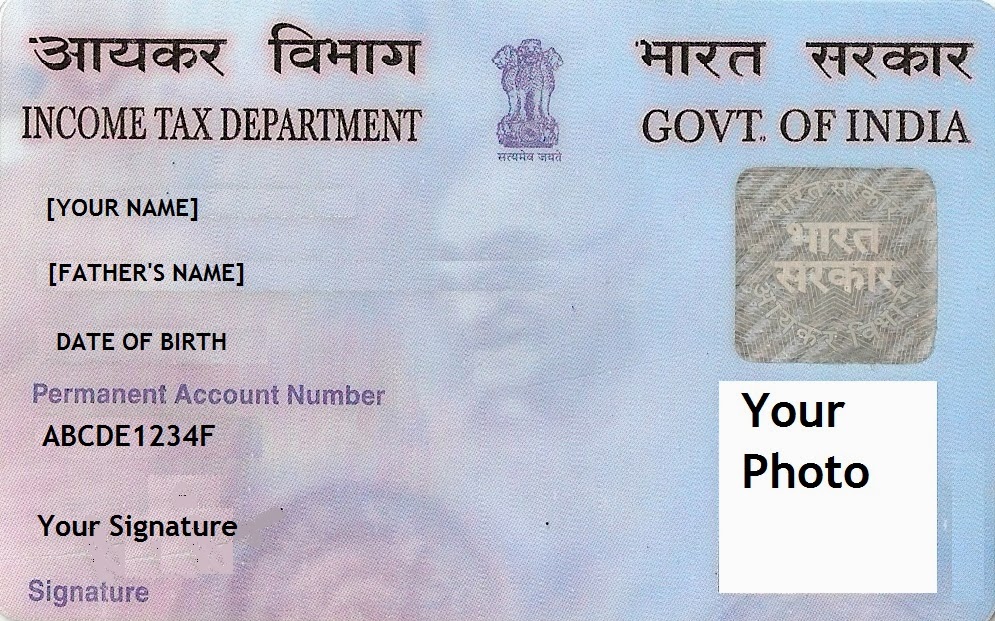

PAN is an alphanumeric code that consists of 10 characters. It is given to all the judicial entities who can be identified under Income Tax Act of 1961.

|

|

|

The PAN card is issued by the Income Tax Department of India. The issuance of the Permanent Account Number card is supervised by the CBDT (Central Board for Direct Taxes). This particular card serves as one of the most important proof of identity for any individual who is a citizen of India or a permanent resident of India. Unlike the driving licence and Aadhar card, the Permanent Account Number card is also issued to the foreign nationals (such as businessmen or investors).

Who should apply for a PAN card?

Any person who earn an amount that is taxable in India should get a PAN card. This list includes the foreign nationals who pay their taxes in India

Any individual who has a business (be it consultancy, services or retail) that has a sales turnover of more than Rs.5 lakh in the last financial year must apply for Permanent Account Number (PAN)

How to apply for Permanent Account Number?

In order to apply for Permanent Account number use form 49AA or 49A as applicable to you. You can get more information about the same on incometaxindia.gov.in

Find out the address of the PAN office in your city from the Income Tax Department’s website or the website of NSDL (National Securities Depository Limited). You must carry your proof of identification along with address proof. The payment for the card can be made using demand draft, cheque or cash. Application can be done online via the websites of National Securities Depository Limited and Income Tax Department. If you apply online, you can choose to pay the fee through net banking, debit card or credit card. The status of your application for the Permanent Account Number can be tracked online.

Why get a Permanent Account Number?

The PAN car is extremely important and has been made mandatory for carrying out different financial transactions.

Applying for a credit card or debit card – When you apply for a debit card or a credit card, you will have to quote your PAN. If you do not submit all the details of your PAN Card, the application will get rejected. Once you face rejection, it might be problematic for you to get a loan in the long run.

Insurance payment – CBDT has made it mandatory for all individuals to submit their PAN details who hold insurance policies. Policy holders paying premiums above Rs.50,000 must submit their PAN details.

Selling or purchasing a vehicle – In case you intend to sell or purchase a vehicle, the cost of which is more than Rs.5,00,000, you must provide the details of your Permanent Account Number.

Selling or buying property – Any property transaction that is more than Rs.5,00,000 required Permanent Account Number mentioned as one of the major documents. If you do not have this, buying a property or selling a property is impossible. If the property is jointly held by two people then PAN details of both people are required for selling or buying the property.

Jewelry purchase – PAN must be provided by the buyer if the cost of the jewelry is more than Rs.5,00,000.

Cash deposit or fixed deposit – If the cash deposit account or the fixed deposit account that you open amounts to Rs.50,000 or more then you will have to provide the permanent account number. If you don’t submit the PAN details then 20% TDS will be deducted for an interest amount that is more than Rs.10,000.

Telephone connection – May it be your landline connection or mobile phone connection, PAN details have been mandated by the Government of India for all the telecommunications companies.

Investing in securities – Any transaction that exceeds an amount of Rs.50,000 for mutual funds, equities, bonds or debentures requires the PAN card of the investor.

Opening account at broker – You must open a share broker account if you wish to trade in the share market. In order to open such an account, PAN details are absolutely necessary. If you fail to provide your Permanent Account Number details, your application will be rejected.

Whether you are just founding your business or are an experienced company owner, you undeniably…

With the rise of online dating, the potential for encountering scammers has increased. Scammers use…

Irritable Bowel Syndrome (IBS) is a functional disorder of gastrointestinal system that resulted by irritability…

Ukrainian entrepreneur Maksym Krippa has officially joined forces with DIM Group, marking a significant new…

The military used scopes and binoculars to survey the area in the past to gather information.…

Who doesn’t love chocolates, right? No matter the age, a chocolate bar with a customized…