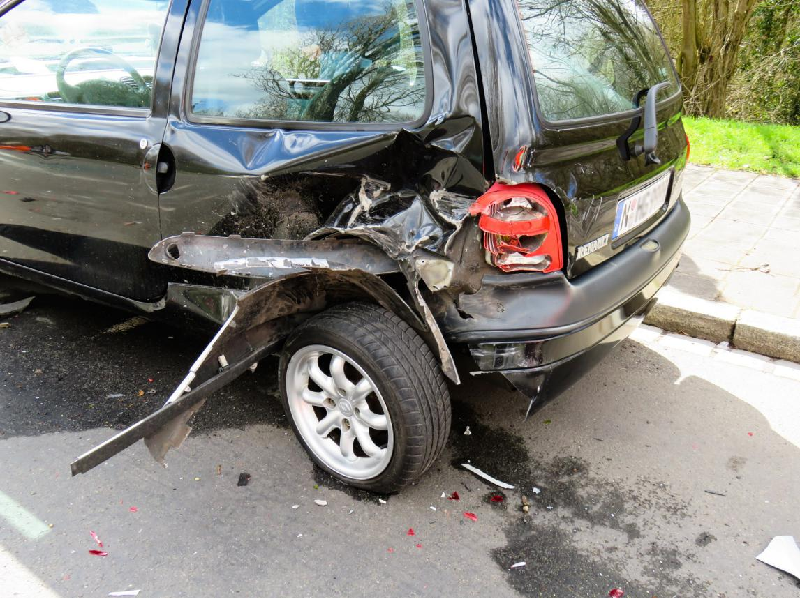

How You Need to Process Medical Care After Being in a Car Crash for Insurance Purposes

After being involved in a car accident, you can have a hard time receiving medical care if you have several different insurance policies in place. A lot of people aren’t sure which coverage to use and end up floundering around until it’s too late.

There are a lot of factors that come into play when it comes to deciding who is at fault, so processing your medical care for insurance purposes can be problematic. Instead of trying to deal with a huge hassle yourself, here’s what you need to keep in mind.

Dealing with Co-Pays, Deductibles, and Injury Bills

In the majority of cases of car accidents, the usual pattern of payment responsibility is followed. First, you have to pay any co-pays or deductibles that are stated in your insurance policy. Many doctors’ offices and hospitals may not require you to pay upfront and may choose to work with you and your insurance company instead to see how much of the medical bill you’re responsible for. To recover quickly, you should seek out top doctors specializing in the treatment of auto accidents injuries.

Auto Policies Pay Out First

Drivers are required to have car insurance of some kind in order to cover basic liability insurance. This is where the payment will come from first before anything else. The amount of coverage differs from company to company, so do your research before you settle on a provider.

The usual order is that medical bills are usually paid by the driver who was at fault first, depending on what their policy limits were. If your insurance provider paid first, then they will make a claim against the provider of the person who was at fault.

The Leftovers in Payments

Once all other financial responsibility has been accepted by other parties, then your insurance provider covers the rest. What is actually covered, however, is dependent on the terms of the policy. So other than co-pays and deductibles, you may still be liable for any payments remaining that aren’t covered under the policy. That’s why it’s a good idea to shop around and read into their terms to ensure you’re getting the most coverage.

Recovering the Rest of Expenses

If you’re not the one at fault in the car accident, then insurance companies will work behind the scenes to get the at-fault person involved and make them responsible for the payments themselves. If you want to recuperate all of your costs, involving those for co-pays and deductibles, then you’d also have to look around for a provider with that option before you sign up.

Sorting out the mess of insurance documents and medical bills can be a daunting task when you’re trying to recover. It never hurts to ask questions to ensure that you have everything covered and put your mind at rest. Just be sure to keep a paper trail and record of everything that you’ve paid so that you can discuss the matter with your provider to see what can be done to recuperate your costs.