Let’s be honest here. Do you know how to read a pay stub? Maybe you set your pay stub aside when it arrives. If it were the actual paycheck, of course, that would be different. But who knows what all those pay stub lines mean?

Perhaps it’s time you started reading pay stubs. If you ever need pay stub information, you should know what is there and why it matters. Here, we’ll look over an example pay stub, line-by-line, and explain the different items.

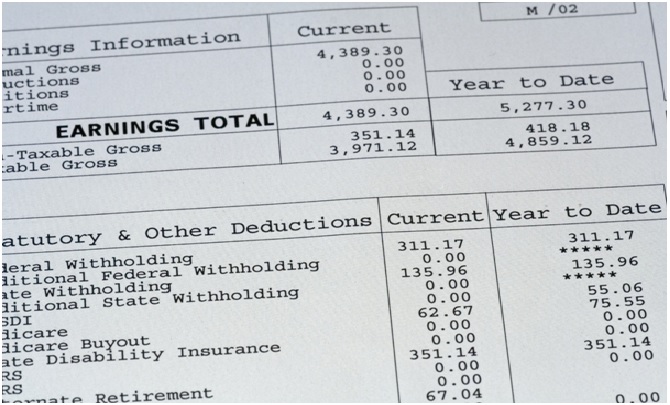

The following sections explain how to read a pay stub—at least the more common items. Once you process all this, you should have a much clearer idea of how your earnings (besides your take-home pay) are used.

Gross pay is your total pay earned during a designated period. It could be from hourly wages, contract pay, or an annual salary. You won’t be surprised to know that you never see this full amount on your paycheck or in your bank account.

Net pay is the amount remaining after all deductions. It’s your take-home pay, the amount deposited into your bank account.

Withholding is the amount of tax collected by the Internal Revenue Service (IRS) at the federal and state levels. It goes toward your federal or state taxes (if your state has income taxes).

If you need to pay local income taxes, your employer will take information from the state version of federal form W-4 and your income to determine how much to withhold.

The government pools the Social Security taxes of employed people to support retirees or the disabled. You should expect to draw from that pool someday yourself.

This deduction is also pooled to cover the health-related expenses of those currently on Medicare. It includes retired people and those with certain health conditions.

These are any extras (“perks”) you might receive along with your regular salary and any bonuses. They include anything from healthcare to a gym membership.

FICA (Federal Insurance Contributions Act) is closely related to Social Security, Medicare, and a few other programs. While these taxes sometimes are listed individually, they may be clustered into a single “FICA” category.

If your employer offers a retirement plan (401k, pension, etc.), your contributions (deducted automatically) appear on your pay stub. We recommend keeping track of these to be sure your retirement savings are sufficient.

Wage garnishment is when your employer withholds a certain amount of your pay (e.g., to pay off a debt)—whether to the employer or an external party.

Back pay is money your employer owes you because of specific adjustments to your payment.

There are other, perfunctory items included on pay stubs, as well, such as your employee ID number or any before or after-tax deductions.

For those needing to produce pay stubs every pay period, did you know that pay stub generators can save time and help you avoid errors? Plus, some of them are customized for your specific needs—for example, a pay stub generator with logo.

Since pay stubs might contain information that is out of date or inaccurate, both employers and employees must know how to read a pay stub and review them periodically for accuracy. The last thing you want is an uncaught error.

Do you want to read more useful information like this? If so, you will always find something worthwhile on our website.

Face masks are the easiest means of having a beautiful looking skin. They make your…

No matter the industry you work in, workplace accidents can occur. Of course, some professions…

Paying medical bills isn’t easy. Healthcare expenses are out of control in the United States,…

There is no doubt that having a good communication with a client is instrumental for…

A t-shirt is one of those apparels that people like wearing. Usually, it is light…

Buying a home is a dream for many, and getting a good home loan interest…